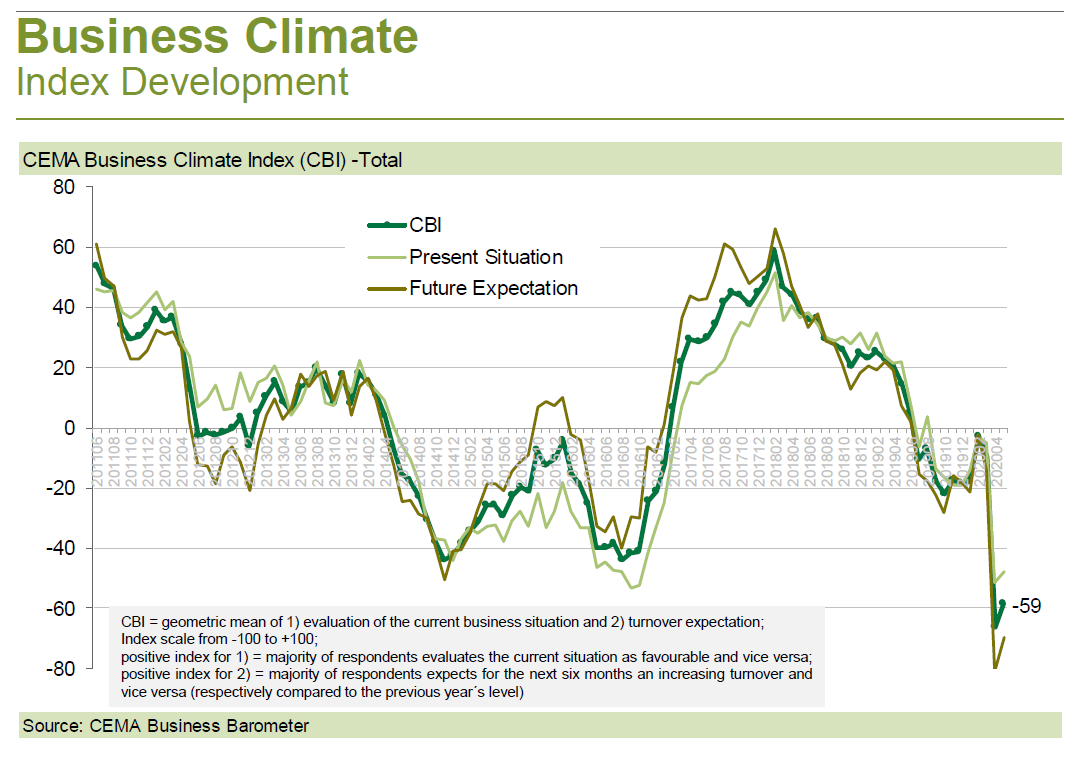

The general business climate index for the agricultural machinery industry in Europe has improved slightly, but continues deeply negative at -59 points (on a scale of -100 to +100) after having dropped as sharply and deeply since the financial crisis of 2008/09. 60% of the industry representatives consider their current business to be unfavorable, 75% expect a declining turnover in the coming six months, according to the May report from CEMA, the European Agricultural Machinery Industry Association.

Although the restrictions in the course of COVID-19 are no longer quite as strong as a month ago, they are still there: on average of all companies participating in the survey, the production capacity utilization is only at 74% of the level before COVID-19. According to the companies, their supplier side is supplying 80% and their partners on the distribution side are running business at only 66% of the level before COVID-19.

Only based on and thanks to the high order intake from the pre-COVID-19 era, the order volume is at a relatively good level. However, the order coverage will continue to melt. For the coming six months, more than 70% of the industry representatives expect further declines in incoming orders.

According to this survey, the actual order intake also dropped further in the last month: almost three quarters of the companies report falling orders, both from the EU market and from outside the EU, with more than half of them even reporting double-digit decreases.

Nevertheless, a little light at the end of the tunnel can be seen: regarding the turnover for the total year 2020, less survey participants (20% instead of 30% one month ago) forecast a decline of more than 20%, which leads to a less negative average industry forecast (arithmetic mean -10% in May versus -13% in April). This correction might be the result of an expectation that the order intake will improve again in a few months so that some losses can be recovered towards the end of the year.