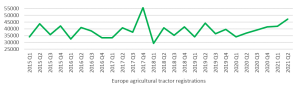

Overall, some 189,242 “tractors” were registered across Europe in the full year 2020, according to numbers sourced from national authorities, reports CEMA, the European Agricultural Machinery representative body. Of these registrations, 49,338 vehicles were 37kW (50hp) and under, and 139,904 were 38kW and above. CEMA considers that 149,667 of these vehicles are agricultural tractors, the rest being quads, telehandlers or other equipment.

Agricultural tractor registrations for the full year 2020 decreased by around 3% in comparison with 2019, a result that would overall indicate relative stability compared to previous years. But the Covid-19 pandemic had a very significant impact, with a drop in registrations of almost 20% in the second quarter of 2020 versus Q2 2019, at a traditional peak time of the year.

Seasonal Agricultural work could not wait, and the industry demonstrated its resilience in the third (+7,5% vs 2019) and fourth quarters (+4% vs 2019) to catch up with demand. This performance, despite Covid-19 production and distribution constraints as well as massive supply chain challenges, was notably made possible by the European Union decision to postpone deadlines for machines using transition engines under 56 kW and over 129 kW. The industry was however concerned about machines using transition engines in the 56 to 129 kW range.

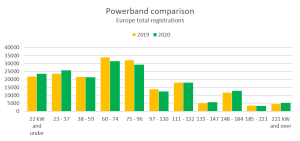

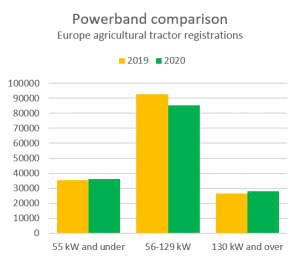

Trends per power categories hint to specific challenge

All power categories were severely impacted by Covid-19 in the second quarter of 2020, some of them up to a dramatic 30% drop versus 2019. Not all could catch up later in the year, as demonstrated by the trends per power category for all vehicles. When filtering out all “other” vehicles from the 2020 registrations and retaining only agricultural tractors, evidence confirmed that the powerband between 56 and 129 kW – which represents up to 60% of the agricultural tractor registrations across Europe – was still facing an 8% drop in registrations in 2020 versus 2019 at the end of the year. As Covid-19 constraints and supply chain challenges continued, the industry renewed the call for a European Union decision to also postpone deadlines for machines using transition engines in the 56 to 129 kW range.

Significant country differences for 2020

The two biggest agricultural tractor markets in Europe remain France and Germany (Graph 4), with those two countries accounting for almost 4 agricultural tractors out of 10 registered in Europe. When adding Italy, 1 agricultural tractor out of 2 goes into just three markets. And with the UK, Spain and Poland included, over two thirds of all agricultural tractors in Europe get registered in only 6 countries. Out of these 6 key markets, only Germany and Poland saw an increase in 2020 agricultural tractor registrations over 2019, while in France, Italy, the UK and Spain, registrations were down.

First semester of 2021 confirms recovery despite supply chain challenges

According to numbers sourced from national authorities, some 115,146 “tractors” were registered across Europe in the first six months of 2021. Of these registrations, 32,353 vehicles were 37kW (50 hp) and under, and 82,793 were 38kW and above. CEMA considers that 89,060 of these vehicles are agricultural tractors, the rest being quads, telehandlers or other equipment. These numbers confirm high levels of demand as farmers, contractors and all other actors of the European agri-food chain went through great efforts to ensure access to safe and nutritious food in times of a continuing pandemic.

Overall, 25% more agricultural tractors were registered across Europe in the first six months of 2021 compared to the first semester of 2020, badly hit by the pandemic. For manufacturers, Covid-19 production and distribution constraints gradually improved in 2021 but did not come back to normal. Significant supply chain challenges remained, with new issues adding to ongoing problems as the world was recovering and competing for scarce supply. The European Union’s decision to postpone deadlines for machines using transition engines in the 56 to 129 kW range proved essential to help industry manage through these extraordinary times.