Petr Thiel, CEO LECTURA, has interviewed Bernd Oppold, Partner KPMG, Maximilian Eberle, Manager KPMG and Simon Zimmermann, Assistant Manager KPMG, about the use cases of the Equipment as a Service (EaaS) in the agricultural sector, construction industry, intralogistics and transportation.

Bernd Oppold (BO) is a partner in the Financial Service Practice at KPMG Germany. Among other things, he leads the KPMG team for building regulated entities in the financial services industry. In this context, KPMG has carried out some interesting projects around the topic of Equipment as a Service (EaaS).

Max Eberle (ME), is a manager in Bernd’s strategy consulting team and responsible project manager for EaaS projects. Simon Zimmermann (SZ), is an expert on leasing matters in Bernd’s strategy consulting team.

The interview on the topic of Equipment as a Service discussed drivers and use cases in the agriculture, construction, logistics and intralogistics sectors today, based on the following statement that “Agriculture: Constant rise in demand for food drives revenue potential”

How can EaaS support the agriculture sector to sustainably meet the growing food demand?

BO: Global economic growth and population dynamics will lead to a worldwide increase in food demand. On the one hand, this creates additional revenue potential for agriculture, but on the other hand, this increased demand can lead to overproduction and price pressure. Smart machines, high-precision robotics in harvesting, and in-field sensors can in turn help reduce costs and sustainably increase throughput to meet global demand in an environmentally friendly and data-driven way.

With the help of EaaS, modern and sustainable agricultural machinery can be flexibly provided to the end customer. For example, Lindner offers smart tractors on a pay-per-use basis. IoT data is used to analyze usage times and behavior in order to make current and future models of the agricultural machine more effective and resource efficient, while providing a data-driven way to determine and invoice runtime-dependent costs via a secure blockchain. The customer thus has the flexibility to manage his liquidity based on seasonality and can even use prepaid payment methods.

“What is the value added to a labor-intensive industry, such as construction, by deploying EaaS?”

ME: One way to address the shortage of skilled workers in the construction industry and increase operational efficiencies is through modular and off-site construction solutions using smart machines and smart networking of construction sites and planning units.

Using IoT sensors, Volvo Construction Equipment, for example, is enabling greater fuel efficiency, productivity and intelligent networking of its excavators. Operating times, maintenance and productivity can be monitored and controlled remotely. With a pay-per-use function, seasonal and cyclical income structures in the construction industry could additionally be smoothened out in a liquidity-preserving way to secure investment in the future.

“Turning to the transportation industry, what does EaaS contribute to a smart and sustainable supply chain and what are the drivers?”

SZ: Globalization and the growth of e-commerce are important drivers for the development of smart solutions such as real-time data transmission and monitoring of all individual steps within a global supply chain via blockchain and IoT. Furthermore, increased environmental awareness is fueling the development of innovative propulsion technologies as well as more efficient resource allocations.

For example with IoT sensors from Traxens, MSC is able to offer smart container solutions that monitor and evaluate positions, vibrations, temperature, movement and door status in real time at sea, on the road and by rail. Efficient data evaluation here offers the possibility of faster and smarter routes, shorter loading times and lower inventories in the global supply chain. The smart container can communicate with other players via interfaces and thus ensures continuous optimization of the supply chain based on a variety of data.

“Intralogistics is also interesting in this context. What are the implications for this industry?”

ME: Highly competitive markets continue to drive operational efficiency through technology-based solutions and warehouse automation. The intralogistics industry is more agnostic about branding and customer loyalty. What counts here is uptime. Machines have to run flawlessly and under high operation.

Smart machines as part of an EaaS solution provide improved productivity, increased speed, reduced downtime and flexible ways to respond to unforeseen market dynamics through IoT and the data derived from it. In addition to comprehensive automation solutions, Linde, for example, could use pay-per-use to make its offering even more flexible and with greater scalability for the end customer.

“In practice, the question of use cases always arises. In your view, what types of machines are particularly suitable for EaaS?“

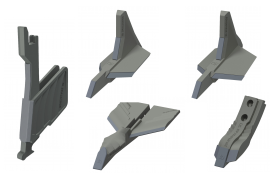

SZ: Initially, mobile, heavily used machines with short replacement cycles will offer an ideal opportunity for Equipment as a Service. Cyclical income structures and capital-intensive industries are further promising starting points, as well as recognizable added value through data analytics.

As a second step, it certainly makes sense to offer EaaS services for immobile or highly customized machines if the added value is sufficient. With a pay-per-part or pay-per-use model, not only the end customer but also the OEM has a great interest in joint growth since higher revenues from product sales for the end customer and revenues from the subscription model for the OEM increase in tandem.

“If you wanted to draw a comparison between all above mentioned industries: When will EaaS arrive as a standard in the respective industries?”

BO: Market entries are never 100% predictable, but we looked at the dynamics in each industry with respect to EaaS. To do this, we tried to find intersections that support a deployment of EaaS based on the identified industry drivers. In doing so, we came up with the following drivers: Short machine replacement cycles, seasonal business model, value added through data analytics, capital intensity, and technology barriers to entry.

In our evaluation, we considered a time horizon of 5 years and came to the assessment that agriculture, with its seasonality and dependence on environmental factors, could benefit most from EaaS in the short term through efficient data evaluation. We also see promising benefits from the liquidity-preserving use of mobile machines in the construction industry and would therefore see it as a contender for early market adoption.

For logistics, in addition to flexibility, we see above all the data-driven increase in efficiency due to global growth in e-commerce as a major asset. However, in order to leverage all the efficiencies, comprehensive coverage via smart components in the supply chain is necessary, which is why the EaaS market entry will only take place at the end of the early market or at the beginning of the mass market. Due to the high complexity and individuality of intralogistics, with the exception of mobile machines, widespread use of EaaS solutions will only take place in the late mass market.

In any case, we are excited to continue to follow market developments and look forward to actively shaping them!

“We’ve seen growth in rental services and solutions within the heavy equipment business – where do you see the interplay between operational leasing and (long-term) rental for EaaS?”

ME: In order to identify and realize the individual added value for all contractual partners, special attention must be paid to the design of the contractual modalities. Off-balance effects, transfer of risks, and tax aspects must be individually tailored to the customer – here, the help of experts is essential.